Bayo is a pioneer in the provision of digital payment as a service in Malaysia. We are a licensed e-money service provider under Section 11 of the Financial Services Act 2013 under the purview of Bank Negara Malaysia. Bayo is also a Principal Member of Mastercard Asia Pacific thus allowing us to offer a myriad of innovative Mastercard digital payment solutions to our clients in Malaysia.

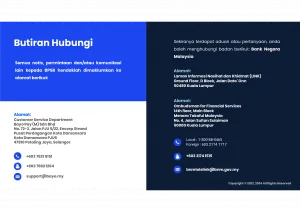

Contact Us

Email:

support@bayo.my

Phone Number:

+603 7621 5151

© Copyright 2021 | Construx Exclusively for CIDB Malaysia Powered by Bayo | All rights reserved | Powered by WordPress